Healthcare consumerism is alive and well in 2023. Healthcare consumers continue to find that many of the advancements to improve patient engagement and health outcomes through data, analytics and AI are worth the investment.

Despite these tools, there are still plenty of misconceptions about healthcare consumers, many of which have been prevalent in the last few years. Here are some healthcare consumer myths that should be debunked in 2023.

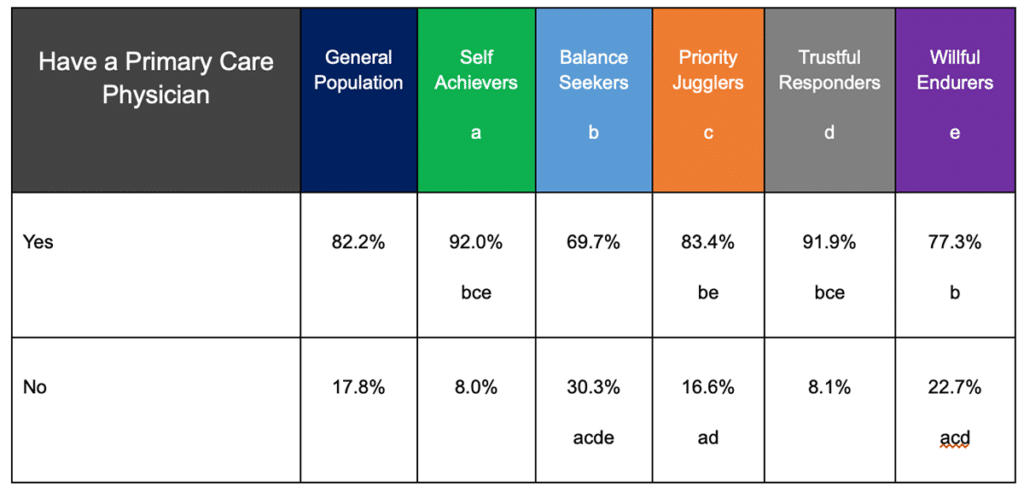

Myth #1: Patients don’t have a primary care.

Over the last few years, new reports have talked about how many people don’t have a primary care anymore. While it may seem that way, there are still plenty of patients with a primary care.

According to Upfront market research, just over 82% of the general population has a primary care. Among patients 35 and older, at least 80% of them have a primary care. For those 75 and older, 98.2% of patients have a primary care, nearly 30% higher than patients that are 18-24 (68.8%).

But when you look at the psychographics, one segment stands out in particular: Balance Seekers. This segment is statistically more likely than all the other segments to not have a primary care doctor. While this segment doesn’t represent a huge portion of the general population (15%), that may not be the case for a local population within a health system.

Through The Bartosch Patient Activation Institute at Upfront, healthcare organizations can utilize our patient engagement research, data and insights to determine how to activate patients in a way that’s personalized to fit their needs. This results in effectively engaging all patients under their terms and improving health equity.

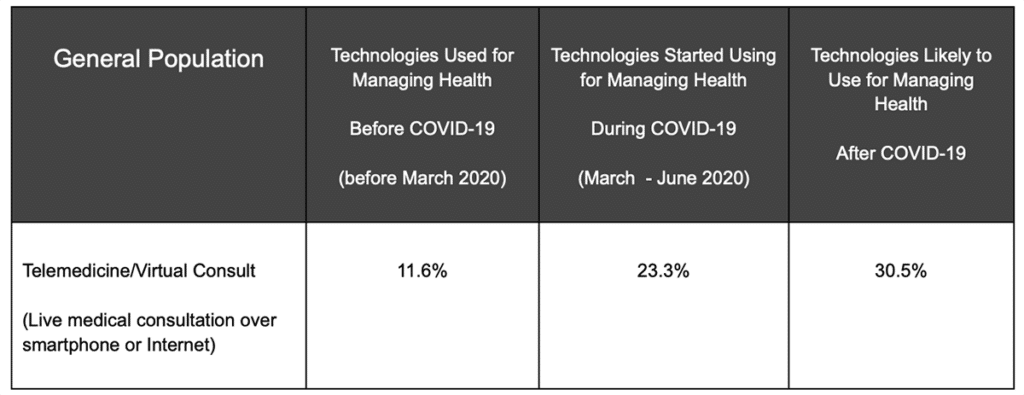

Myth #2: Patients have moved on from telehealth.

Telehealth isn’t dead. Sure, it isn’t thriving like it was in 2020 and 2021, but it’s certainly evolved since then.

Prior to 2020, few healthcare consumers knew what it was, let alone tried it. Upfront’s market research found that only 11.6% of the general population tried telehealth and virtual visits prior to March 2020. But between March and June 2020, 23.3% of the general population used these technologies and 30.5% of healthcare consumers said they would use these options in the future to manage their health.

Today, Upfront market research shows that 46.1% of the general population is extremely/very open and willing to use telehealth/virtual visits for non-life treating issues. 29.9% were at least somewhat open and willing to receive care this way and only 24.0% were not very/not at all open and willing to get this care this way at all.

As digital health continues to grow, so do the expectations of healthcare consumers. Even in 2020, Upfront market research found that 60.0% of patients expected healthcare providers to have a telehealth or virtual visit option. And now that patients know telehealth is an option, they’ll use it if they need it, especially if they’re too sick to go in the doctor’s office or if they need the flexibility to meet with their doctor from anywhere. Now that telehealth is much more prevalent and people know that it’s an option, it is still a viable option moving forward.

Myth #3: COVID changed our views on health.

COVID didn’t completely change everyone’s views on their health, but it did for some healthcare consumers.

At Upfront, we use a segmentation model to better engage with healthcare consumers called psychographic segmentation. This model taps into the values, lifestyles, beliefs and more to determine what motivates them to act on their health. Healthcare consumers under Upfront’s model are broken down into five segments: Self Achievers, Balance Seekers, Priority Jugglers, Trustful Responders and Willful Endurers.

Each healthcare consumer has a dominant, secondary and tertiary segment and during the pandemic, one segment, Priority Jugglers, leaned into their secondary characteristics, Willful Endurers, more than normal. However, after four years, these shifts didn’t change among this segment, because their views had changed. As a result, Upfront updated the percentages of the general population under these segments.

These misconceptions articulate how important it is for healthcare organizations to continually look at their data and analytics to determine changes in their healthcare consumers.

Find out how healthcare organizations can use psychographic segmentation to personalize patient engagement to motivate patient behavior in Upfront’s whitepaper.